What is the ESG strategy of sustainability? Blueprint for the Future

Jessica Gonzalez

Global Chief Executive | Founder Happen Ventures

Every time you take a breath, you’re inhaling a planet in distress. Our Earth, once brimming with lush green forests and crystal-clear waters, now grapples with the scars of human ambition. As we stand at the crossroads of 2023, the corporate world is not just witnessing a change, it’s at the heart of it. ESG solutions, once a boardroom jargon, has now become the beacon of hope for a sustainable future.

A staggering 70% of retail investors, as highlighted by World Finance, are no longer just chasing profits; they’re demanding responsibility. They’re seeking businesses that don’t just aim for the next quarterly report but look beyond, to the environment, their employees, the intricate webs of their supply chains, and the communities they touch.

But what does this ESG wave truly signify? It’s not just a trend, it’s a revolution. This article will take you on a journey, unraveling the essence of Environmental, Social, and Governance, its profound impact on our world, and how it’s reshaping the very fabric of business.

So, if you’ve ever wondered about the future of sustainable business, you’re in for an enlightening ride.

Table of Contents

The ESG Landscape in 2023: Beyond the Buzz

The ESG wave has been surging, and 2023 is no exception. With global challenges like inflation, geopolitical unrest, and market fluctuations, ESG might seem like a backseat issue. However, as stability gradually returns, the ESG ascent is undeniable.

But what does it truly entail? At its core, it signifies a shift from mere profit-driven motives to a sustainable business model that holistically considers environmental, social, and governance factors.

With global initiatives like Net Zero 2050 and Biden’s Green New Deal, the pressure on corporations to enhance their Environmental, Social, and Governance performance is mounting.

The Financial Implications of ESG

Contrary to some beliefs, strong ESG practices aren’t just about saving the planet; they’re closely tied to financial performance.

Research from J.P. Morgan Asset Management reveals that capital inflows into the renewables sector have surged by almost 1000% in 15 years, indicating a long-term trend.

Moreover, sectors like renewable energy and advanced recycling have witnessed significant growth, especially post the announcement of Biden’s Green New Deal.

However, it’s essential to understand that ESG is a marathon, not a sprint. Companies need to adopt sustainable practices that ensure long-term growth rather than short-lived spikes.

The Tangible Benefits

- Risk Management: Companies that integrate ESG factors into their business models can better anticipate and manage risks. For instance, businesses that prioritize environmental sustainability are less likely to face regulatory fines or reputational damage.

- Operational Efficiency: Sustainable practices, such as energy efficiency and waste reduction, can lead to significant cost savings in the long run.

- Brand Enhancement: A strong ESG profile can enhance a company’s brand, making it more attractive to consumers, employees, and investors.

- Access to Capital: Investors are increasingly looking at ESG factors when making investment decisions. Companies with strong ESG profiles can attract more capital and potentially at a lower cost.

The Crypto Conundrum: ESG’s New Frontier

Cryptocurrencies, despite their popularity, are notorious for their environmental footprint. Bitcoin, for instance, consumes more electricity annually than countries like Sweden or the UAE. However, the ESG movement is prompting a shift towards green mining practices.

Companies like Vespene are pioneering methods that convert methane gas into electricity for mining, effectively reducing carbon emissions.

Moreover, there’s a growing push to transition from energy-intensive Proof of Work (PoW) models to more efficient Proof of Stake (PoS) systems, which could drastically reduce Bitcoin’s carbon footprint.

Regulatory Shifts: The New ESG Paradigm

Historically, ESG initiatives were often voluntary, driven by PR motives. However, 2023 marks a turning point with countries introducing legislation to formalize corporate responsibility.

The EU’s expansion of its 2020 Taxonomy classification and Germany’s Supply Chain Due Diligence Act are just the tip of the iceberg. Such regulations mandate companies to ensure ethical practices throughout their supply chain.

With the introduction of directives like the Corporate Sustainability Reporting Directive (CSRD) and the UK FSA’s Sustainability Disclosure Requirements (SDR), businesses will soon find it challenging to operate without a robust ESG strategy.

Local Initiatives: The Heart of ESG

While global strategies are vital, local initiatives often yield the most significant impact. Companies like Libertex are leading the way with their commitment to sustainability and ethical practices.

By engaging in charitable activities, supporting children’s rights, and ensuring employee satisfaction, they exemplify how local actions can drive global change.

As ESG becomes mandatory across regions, such initiatives will not only enhance a company’s reputation but also its profitability.

The Role of Education in Promoting ESG

- Awareness Campaigns: Educational institutions are increasingly organizing campaigns to raise awareness about the importance of ESG among students and the broader community.

- Curriculum Integration: Many universities and business schools are integrating ESG topics into their curriculum, ensuring that the next generation of leaders is well-equipped to tackle sustainability challenges.

- Research and Development: Academic institutions are at the forefront of research in sustainable technologies and practices, driving innovation in the ESG space.

Happen Ventures: Pioneering the ESG Revolution

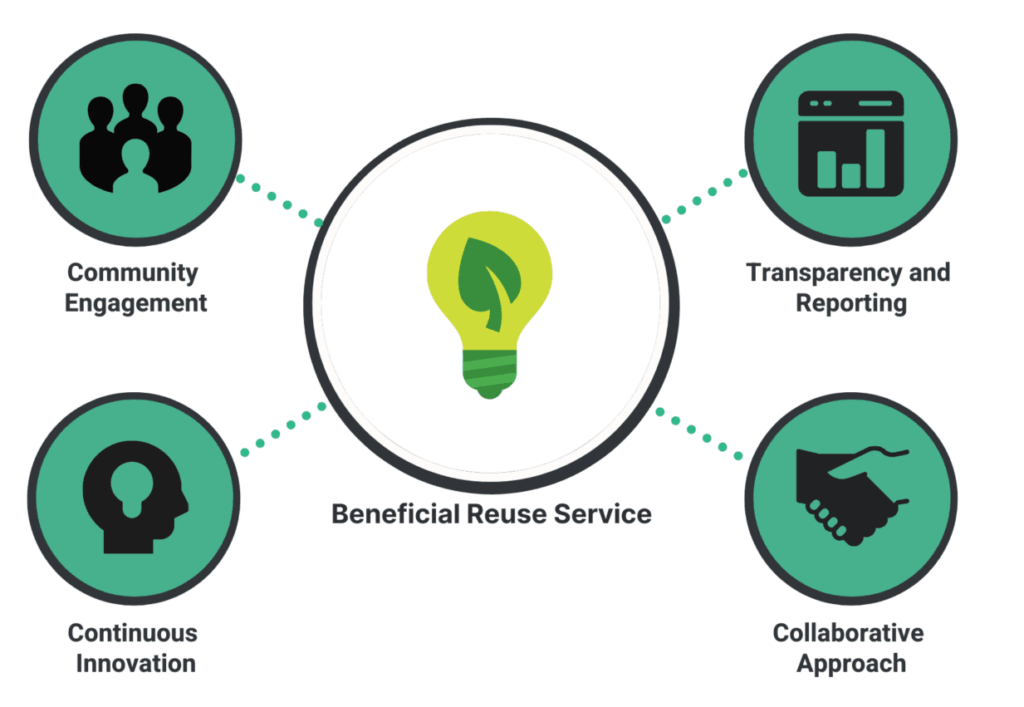

In this evolving landscape, Happen Ventures emerges as a beacon of hope. Their Beneficial Reuse Service offers businesses an eco-friendly solution, reducing waste management costs and bolstering their ESG score.

By supporting local communities and making a positive environmental impact, Happen Ventures exemplifies the future of business – one that’s sustainable, ethical, and profitable.

Conclusion:

The ESG movement is more than a trend; it’s the future of business. As we navigate the challenges of 2023 and beyond, companies and investors must recognize the profound impact of ESG on the corporate landscape.

By adopting sustainable practices, staying updated with regulatory changes, and prioritizing local initiatives, businesses can ensure a prosperous and sustainable future.