ESG Solutions Guide 2024: Steering the New Era of Responsibility

Have you ever wondered about the broader impact of your favorite brands on our world? In today’s consumer landscape, every purchase decision is increasingly scrutinized for its ethical and environmental footprint. A pivotal shift in 2023 shows that nearly half of consumers now expect brands to lead in creating sustainable change[1]. This evolving mindset reflects a critical juncture where businesses, knowingly or unknowingly, are part of a larger narrative involving environmental sustainability, social responsibility, and governance. ESG solutions, far from being mere corporate buzzwords, have become essential to the ethos of modern business practices.

As the tides of consumer sentiment shift, ESG solutions stand as the beacon guiding businesses towards a sustainable, ethical, and profitable future. Dive in with us as we unravel the intricacies of ESG and its profound impact on the modern business landscape.

Table of Contents

What does ESG stand for? A Glimpse into Its Core

Environmental, Social, and Governance (ESG) forms the cornerstone of modern business sustainability and ethical impact assessment. At its core, ESG represents a triad of crucial areas: environmental stewardship, social responsibility, and effective governance. These pillars are pivotal in today’s investing and operational landscapes, shaping how businesses address non-financial risks and opportunities inherent to their daily activities[2].

What is ESG in simple words?

ESG is the ethical backbone of a company. It’s how a business treats the planet (Environmental), its people (Social), and how it governs itself (Governance). In 2023, organizations are evolving their ESG and sustainability priorities, indicating a shift from mere rhetoric to actionable strategies.

What are ESG services? Charting the Green Landscape

ESG services are specialized offerings that help businesses navigate the complexities of sustainability, ethical labor practices, and corporate responsibility.

They address pressing issues like climate change, greenhouse gas emissions, and a company’s overall energy usage. In the fast-paced business world, many companies are seeking quicker routes to achieve their ESG goals.

This leads us to an emerging trend: fast track ESG. But what is fast track ESG? It’s a streamlined approach, offering businesses accelerated strategies and solutions to meet ESG standards without the usual lengthy processes.

- PwC: PwC’s ESG services focus on building resilience and trust by helping businesses manage their environmental, climate, and social impacts. Their teams provide strategic guidance to ensure businesses are aligned with global ESG standards.

- EY: EY offers ESG sustainability solutions and ESG strategy services that help businesses create long-term value. Their services encompass strategy formulation, M&A, capital allocation, ESG due diligence, and portfolio optimization.

- Antea Group: Antea Group’s ESG advisory services assist clients in understanding and proactively managing their ESG risks and opportunities. Their consultants provide expert guidance tailored to the specific needs of businesses.

- Deloitte: Deloitte’s Audit & Assurance Sustainability and ESG Services team focuses on ESG integration, reporting, and assurance. They help organizations make significant progress in aligning their operations with global ESG benchmarks.

- Grant Thornton: Recognizing the importance of ESG for investors, executives, audit committees, and boards, Grant Thornton offers comprehensive ESG services that cater to the evolving needs of businesses.

These firms, among others, play a pivotal role in guiding businesses towards a sustainable and ethical future. As the emphasis on ESG continues to grow, businesses are increasingly seeking the expertise of these service providers to ensure they remain compliant, sustainable, and ethically responsible.

Why is it called ESG?

ESG stands for the three critical pillars of sustainability: Environmental, Social, and Governance. Each pillar represents a unique aspect of a company’s impact on the world, from its carbon footprint to its community engagement and leadership ethics.

What are the key areas of ESG service? Pivotal Points Unearthed

The primary areas of ESG service include ESG materiality assessments, strategy formulation, reporting, and ratings. These services help businesses understand their ESG performance and how it compares to industry benchmarks.

What are the three pillars of ESG sustainability?

The three pillars are:

- Environmental: Focuses on a company’s impact on the environment, including waste management and carbon footprint. With the global ambition to reach net zero by 2050, businesses are evolving their environmental strategies.

- Social: Addresses issues like employee welfare, community involvement, and human rights. This includes transitioning workforces and ensuring a ‘just transition’ for communities affected by major industrial shifts.

- Governance: Pertains to a company’s leadership, executive pay, audits, internal controls, and shareholder rights. Transparency in governance is crucial, with accurate disclosure building trust among stakeholders.

What is the full form of ESG in software? Beyond the Acronym

ESG software is a digital solution designed to help businesses track, manage, and report their Environmental, Social, and Governance initiatives. It provides insights into business practices, performance, sustainability, and more.

What is ESG software?

ESG software is a tool that helps ESG organizations measure, manage, and communicate their ESG performance. As businesses increasingly recognize the importance of sustainable and ethical operations, ESG software solutions have become indispensable.

These tools not only assist in tracking and reporting ESG metrics but also provide actionable insights to improve overall ESG performance.

- Intelex ESG Management Software: This software focuses on environmental, social, and governance management, providing a holistic approach to ESG compliance.

- Novata: A versatile ESG software solution that has garnered positive reviews for its user-friendly interface and robust features.

- Metrio: An end-to-end sustainability and ESG reporting software that simplifies the process of gathering, analyzing, and sharing ESG data.

- Greenly: A platform that emphasizes carbon footprint analysis and offers actionable insights for businesses to reduce their environmental impact.

- Benchmark ESG Reporting: A cloud-based ESG reporting platform that streamlines the process of ESG data collection and analysis.

These software solutions are designed to cater to the diverse needs of businesses, ensuring that they can effectively navigate the complex landscape of ESG compliance.

What is the name of ESG software?

There are various ESG global solutions available in the market, each tailored to specific industry needs. As ESG becomes more mainstream, we can expect the development and introduction of more advanced ESG technology solutions in the market.

Who needs ESG software?

Any organization aiming to improve its ESG performance, from small startups to multinational corporations, can benefit from ESG software. This includes businesses looking to align their operations with global net-zero ambitions and those seeking to ensure a just transition for their workforces.

How to choose ESG software?

Choosing the right ESG software depends on your organization’s specific needs, the size of your company, the industry you’re in, and your budget. It’s essential to consider the software’s capabilities in terms of tracking, reporting, and analyzing ESG metrics.

What is an ESG consultant? The ESG Trailblazers

An ESG consultant provides expert guidance to organizations aiming to integrate ESG principles into their operations. They evaluate, measure, and manage a company’s ESG performance, ensuring alignment with global standards.

Is ESG Consulting a good career?

Absolutely. With the rising emphasis on sustainability and ethical business practices, ESG consulting is a rapidly growing field offering numerous opportunities. ESG consultants play a crucial role in guiding businesses through the complexities of ESG compliance, making it a rewarding and impactful career choice.

What is ESG consulting firms?

ESG consulting firms specialize in offering expert advice, tools, and strategies to businesses for enhancing their ESG performance. These firms have a deep understanding of global ESG standards and regulations, ensuring that their clients remain compliant and ahead of the curve.

What is ESG compliance? The Blueprint of Responsibility

ESG compliance refers to adhering to established guidelines and standards related to environmental, social, and governance factors. It’s about being responsible stewards of the environment, being accountable managers, and ensuring transparent reporting.

How do you ensure ESG compliance?

Ensuring ESG compliance involves regular audits, transparent reporting, and adhering to global ESG standards and regulations. With the dynamic political and regulatory landscape in 2023, businesses must stay updated on the latest ESG regulations and ensure that their operations align with these standards.

What are the goals of ESG compliance?

The primary goals are to promote sustainable business practices, ensure ethical operations, and enhance transparency. ESG compliance aims to strike a balance between profitability and responsibility, ensuring that businesses contribute positively to society and the environment.

Is there an ESG regulation?

Yes, various global and regional regulations guide ESG compliance, ensuring businesses operate ethically and sustainably. In 2023, we can expect ongoing political and regulatory changes related to ESG, with governments and regulatory bodies introducing new standards and guidelines.

Who regulates ESG?

Several global bodies, including the United Nations and regional entities, provide guidelines and regulations for ESG compliance. These bodies ensure that businesses adhere to global ESG standards, promoting sustainability and ethical operations.

Why is ESG regulation important?

ESG regulations ensure that businesses operate in an ethical and sustainable manner, protecting the environment and ensuring social responsibility. With the increasing consequences of greenwashing, ESG regulations play a crucial role in holding businesses accountable for their actions.

In January 2023, the European Union (EU) established a significant benchmark in ESG compliance with the adoption of the Corporate Sustainability Reporting Directive (CSRD). This directive mandates both EU and non-EU companies active in the EU to file comprehensive annual sustainability reports. These reports, aligned with the European Sustainability Reporting Standards (ESRS), are a substantial step in ensuring transparent and detailed disclosure of corporate sustainability practices. The ESRS, which became law on July 31, 2023, and applies to all 27 EU member states, delineates clear and rigorous requirements for sustainability reporting. Companies must now engage in thorough materiality assessments and report on identified impacts, risks, and opportunities across their operations, including their supply and value chains. These new mandates signify a leap towards more accountable and sustainable corporate behavior within the EU[3].

What is the ESG strategy of sustainability? Blueprint for the Future

The ESG strategy of sustainability focuses on creating a balance between business operations and their impact on the environment, society, and governance. It’s about ensuring long-term business success while minimizing negative impacts.

What are 3 principal ESG strategies?

- Environmental Strategy: Reducing carbon footprint, waste management, and promoting renewable energy. With global crises like COVID-19 and geopolitical tensions affecting supply chains, businesses are focusing on building resilient and transparent supply chains that align with ESG principles.

- Social Strategy: Ensuring employee welfare, community engagement, and promoting diversity and inclusion. The transition to a sustainable future requires businesses to consider their organizational structure, culture, and behaviors.

- Governance Strategy: Transparent reporting, ethical leadership, and stakeholder engagement. Accurate disclosure is key to building trust among stakeholders, and businesses must ensure that their governance practices are transparent and ethical.

What is ESG and example?

ESG stands for Environmental, Social, and Governance. An example would be a company investing in renewable energy (Environmental), promoting employee welfare (Social), and ensuring transparent reporting (Governance).

What is the meaning of ESG solutions? Delving Deeper

ESG solutions refer to tools, strategies, and services that help businesses address and manage their ESG challenges. They provide insights into potential risks, offer strategies for improvement, and ensure compliance with global standards.

What are ESG products?

ESG products are offerings that adhere to ESG principles, from sustainable goods to ethical financial products. These products align with global ESG standards, ensuring that they contribute positively to the environment and society.

How do companies use ESG?

Companies use ESG as a framework to guide their operations, ensuring they operate ethically, sustainably, and responsibly. With the increasing focus on ESG in 2023, businesses are evolving their ESG strategies, ensuring that they align with global ambitions and standards.

Happen Ventures’ Beneficial Reuse: The Game-Changer for ESG Scores

ESG solutions, where every initiative and strategy is scrutinized for its authenticity and impact, Happen Ventures introduces a groundbreaking approach: the Beneficial Reuse Service. But what sets it apart in the crowded space of ESG solutions?

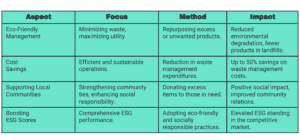

- Eco-Friendly Management of Excess Products: Traditional waste management methods often lead to environmental degradation, with excess products ending up in landfills or being disposed of in ways harmful to the environment. Happen Ventures’ Beneficial Reuse Service offers an alternative. Instead of discarding excess or unwanted products, they are repurposed, ensuring minimal waste and maximum utility.

- Significant Cost Savings: While many ESG initiatives come with increased operational costs, the Beneficial Reuse Service stands out. Businesses can experience substantial cost savings, with reductions of up to 50% on waste management expenditures. This not only boosts the bottom line but also showcases a company’s commitment to efficient and sustainable operations.

- Supporting Local Communities: Beyond the environmental benefits, the Beneficial Reuse Service has a profound social impact. Excess items are donated to local communities, providing essential goods to those in need. This strengthens community ties, enhances a company’s social responsibility profile, and resonates deeply with consumers who value businesses that give back.

- Boosting ESG Scores: With its dual focus on environmental sustainability and social responsibility, the Beneficial Reuse Service directly contributes to improving a company’s ESG score. As businesses are increasingly evaluated on their ESG performance by investors, consumers, and regulators, adopting such innovative solutions can set a company apart in the competitive market.

Happen Ventures’ Beneficial Reuse Service isn’t just another ESG solution, it’s a holistic approach that addresses environmental, social, and economic aspects simultaneously. For businesses aiming to elevate their ESG standing while making a tangible difference in the world, this service offers a promising path forward.

Conclusion

ESG is not just a buzzword, it’s a necessity. As businesses face increasing scrutiny from consumers, investors, and regulators, the importance of ESG compliance cannot be overstated. And here’s where Happen Ventures’ Beneficial Reuse Service comes into play.

By offering an eco-friendly solution for managing excess products and supporting local communities, it not only boosts a company’s ESG score but also brings about tangible cost savings. In the evolving landscape of business, ESG is the compass that will guide companies towards a sustainable and ethical future.

References

[1] NielsenIQ. (2023). “Trend watch 2023: Sustainability.”

[2] Deloitte. (2023). “What is ESG?”

[3] Harvard Law School Forum on Corporate Governance. (2023). “EU Adopts Long-Awaited Mandatory ESG Reporting Standards.”