What is the difference between philanthropy and charity? A Discerning Look

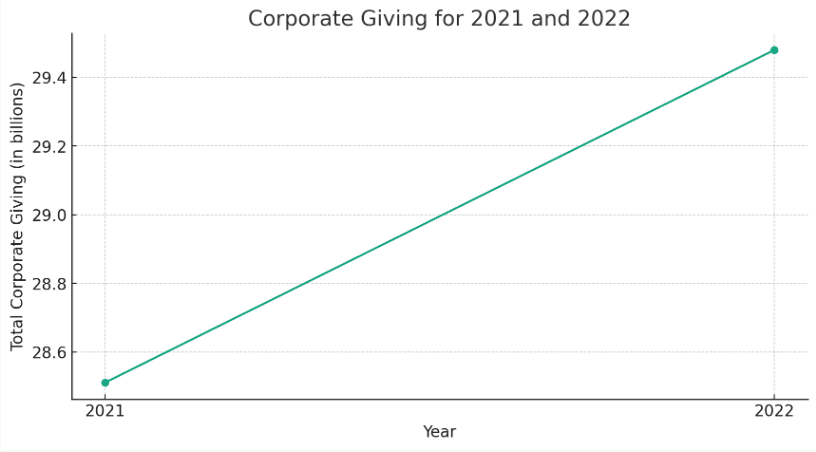

In today’s corporate landscape, the concept of corporate donation has transitioned from a mere act of goodwill to a strategic cornerstone of business ethos. With a staggering $29.48 billion in corporate giving reported by Giving USA in 2023, the question arises: how can these contributions transcend monetary value to genuinely foster societal progress?

This article seeks to demystify the strategic significance of corporate donations, guiding businesses on how to ensure that every dollar donated not only supports worthy causes but also aligns with their corporate identity and values.

Table of Contents

The Essence of Corporate Giving

Corporate donations have emerged as a vital force in the tapestry of societal development. With corporate giving estimated to have increased by 3.4 percent in 2022, totaling $29.48 billion according to the Giving USA 2023 Report, the influence of businesses in shaping societal outcomes has never been more pronounced.

This section will delve into the transformative potential of corporate philanthropy, examining how strategic giving can create a symbiotic relationship between a company’s growth and its social footprint.

Defining Corporate Donation and Philanthropy

Corporate donation is an investment in society’s future. It’s a commitment that transcends the transactional to become transformational. Philanthropy, the broader term, paints a picture of a company’s legacy on the canvas of societal needs.

It’s not just about the funds, it’s about fostering partnerships, engaging in community development, and driving sustainable change. Companies today are expected to be more than just economic entities, they are seen as pillars of the community with the power to influence and enact positive change.

Charity vs. Philanthropy: Understanding the Distinction

Charity provides immediate relief, acting as a quick response to urgent needs, such as disaster relief or food banks. Philanthropy seeks to address and solve underlying problems for long-term change, like funding education initiatives or supporting policy reform.

Both are essential, but understanding their roles and effects is pivotal for a comprehensive corporate giving strategy. It’s about knowing when to provide a lifeline and when to build a bridge to the future.

Strategic Philanthropy: Beyond the Buzzword

Strategic philanthropy has become a beacon for companies aiming to align their business objectives with community development. The Double the Donation report highlights a trend towards increased involvement of small and mid-size companies in philanthropy for 2023, signaling a shift towards more inclusive and diverse corporate giving strategies.

This section will explore how companies can leverage their unique positions to foster long-term societal benefits while also reaping the intrinsic rewards of a socially conscious brand.

The Strategic Approach to Corporate Donations

Strategic philanthropy aligns a company’s charitable efforts with its core values and business objectives, creating a synergy that amplifies the impact of each contribution. It’s about finding the sweet spot where company interests and community needs intersect.

For instance, a tech company might invest in STEM programs for underprivileged youth, aligning with its industry and building a future talent pool, while also addressing educational inequality.

Measuring Impact: More Than Just a Number

The true measure of a corporate donation is its outcome, not just its monetary value. Tools for measuring impact, such as social return on investment (SROI), are becoming more prevalent, helping companies to see the real-world effects of their contributions.

For example, a company might track how its donations to a local shelter lead to a decrease in homelessness or an increase in employment among the shelter’s clients.

The Happen Ventures Model: A Case Study in Strategic Giving

Happen Ventures revolutionizes strategic giving by converting corporate excess into community benefits, merging sustainability with philanthropy to drive social change.

This section will provide an in-depth look at their model, illustrating the practicalities and benefits of their approach to corporate giving.

Happen Ventures’ Approach to Philanthropy

Happen Ventures reimagines the traditional donation model by converting corporate excess into community abundance.

This approach not only supports sustainability but also ensures that donations are directed where they are most needed.

Companies collaborating with Happen Ventures redirect their surplus products to support community, educational, and disaster relief programs, preventing waste.

The Logistics of Giving: A Behind-the-Scenes Look

The path from warehouse surplus to community enrichment is intricate. Happen Ventures simplifies this journey, managing the complexities of logistics to ensure that the act of giving is as effective as it is generous.

They handle the sorting, packaging, and distribution of donated goods, ensuring they reach the intended recipients in a timely and efficient manner.

Tax Benefits and Fair Market Value: A Primer for Corporates

Understanding the intricacies of Fair Market Value (FMV) and tax benefits is crucial for corporations engaging in philanthropy.

This section provides a basic understanding of FMV calculation and tax deduction implications, referencing latest IRS guidelines and tax law updates

Understanding Fair Market Value in Donations

Fair Market Value (FMV) is the estimated market value of an item if it were sold on the open market. It is a critical concept in determining the value of donated goods for tax purposes, allowing companies to accurately report their contributions.

For instance, a company’s donated clothing’s FMV is based on its current discount store value, not the initial retail price.

Navigating Tax Benefits Without Giving Tax Advice

While this article can’t replace professional tax advice, it provides a general understanding of tax deductions for donations. Being well-informed of the rules enables companies to maximize the benefits of their charitable efforts.

For instance, understanding the difference between donating cash versus products can significantly affect the tax benefits a company can claim.

Partnering for Impact: Selecting the Right Non-Profits

The selection of non-profit partners is a strategic decision that can significantly amplify the impact of corporate donations.

This section outlines criteria for selecting non-profit partners, highlighting the 2023 State of Social Impact Report’s findings on retailers’ growth through charitable contributions and sales, and emphasizing smaller charities’ critical role in philanthropy.

Criteria for Choosing Non-Profit Partners

The right partnership between a corporation and a non-profit can significantly enhance the impact of a donation. Selecting the right partner involves aligning missions, assessing effectiveness, and ensuring transparency for a successful collaboration.

It’s about due diligence and shared goals, ensuring that the non-profit’s objectives resonate with the company’s vision for community impact.

The Role of Smaller Charities in Corporate Philanthropy

Smaller charities may operate quietly but can be highly effective in driving change. Happen Ventures recognizes their potential, ensuring that corporate donations reach those who can make the most significant impact. These smaller entities often have deeper community ties and a more profound understanding of local needs, making them invaluable partners in corporate philanthropy.

The Corporate Donor’s Journey: From Decision to Action

Embarking on a philanthropic journey is a deliberate and thoughtful process that reflects a company’s commitment to societal welfare.

Guide on the donation lifecycle, from deciding to give to the final contribution, highlighting the significance of each phase for impactful corporate donations.

Making the Commitment to Give

The decision to give marks the beginning of a philanthropic journey. It’s about integrating giving into the corporate culture, involving employees, and making philanthropy a defining aspect of the company’s identity.

It’s a commitment that requires thoughtful planning, a clear vision, and a willingness to engage in the long haul.

The Donation Lifecycle

The donation lifecycle, from the initial pledge to the final delivery to a charity partner, is a testament to a company’s dedication to societal welfare. It’s a process that, when executed with care, leaves a lasting positive mark on both the giver and the recipient.

Select ideal donation items, ensure quality, manage transport logistics, and witness the impact directly.

Conclusion

In conclusion, corporate giving is not just a campaign, it’s an integral chapter in a company’s story. It’s a narrative that can define a brand, inspire a workforce, and, most importantly, make a tangible difference in the world. This is a call to action for businesses to not just