Imagine a world where every corporate giant becomes a catalyst for change, not just a byword for profit. In this world, the term “corporate donation” isn’t just a buzzword, it’s the heartbeat of a business ethos that pumps vitality into community veins.

Recent research from the National Philanthropic Trust reveals a seismic shift: corporate giving surged to $21 billion in the last year, reflecting a growing conscience within the boardrooms of America. Yet, this surge uncovers a stark reality, while the coffers open wider, the strategy and impact measurement lag behind.

This is the conundrum that grips the corporate world today. How do we transform this financial flow into a strategic force for good?

This article dives deep into the mechanics of meaningful corporate donations, shedding light on the often-overlooked nuances of fair market value, tax benefits, and the transformative approach of Happen Ventures.

Get ready to understand how companies help out in the community. Each bit of help they give tells a story about what can be achieved, the difference it can make, and how it helps make things fairer for everyone.

Table of Contents

Corporate Philanthropy Definition: The Core Unveiled

Corporate philanthropy has transcended beyond mere charity, it’s now a strategic framework for businesses to contribute to societal welfare while enhancing their own value.

According to the Conference Board’s 2023 insights, amidst economic downturns and geopolitical instability, companies are increasingly leveraging philanthropy as a tool for corporate citizenship, embedding it into their core business strategies for greater impact.

What is the meaning of corporate philanthropy?

Corporate philanthropy is the strategic alignment of a company’s mission with societal needs, creating a ripple effect of positive change.

It’s about leveraging corporate resources to address social issues, a concept that Happen Ventures has mastered by turning surplus inventory into valuable community assets, thus elevating both corporate image and societal well-being.

How do you account for inventory donations? Precision in Philanthropy

Accounting for inventory donations is a nuanced process that hinges on the Fair Market Value (FMV) of the donated items, which plays a crucial role in determining potential tax benefits.

Calculating Tax Benefits Based on FMV

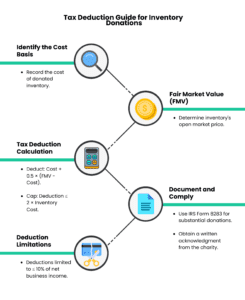

The tax benefits for inventory donations are calculated as follows:

- Identify the Cost Basis: Record the cost of the inventory being donated.

- Estimate the FMV: Determine the open market price of the inventory.

- Compute the Deduction: The IRS permits a deduction of the cost plus half the difference between FMV and cost, capped at twice the inventory cost.

- Document and Comply: For substantial donations, complete IRS Form 8283 and secure a written acknowledgment from the charity.

- Recognize Limitations: Deductions are typically limited to 10% of the taxpayer’s net income from all businesses contributing the inventory.

According to the IRS, the deduction calculation involves identifying the cost basis of the inventory, estimating its FMV, and then computing the deduction, which is typically the cost plus half the difference between FMV and cost, subject to certain limitations[1][2].

For instance, if a company donates inventory with a cost of $10,000 and an FMV of $15,000, the allowable deduction would be the cost ($10,000) plus half the FMV excess ($2,500), which totals $12,500. This falls within the limit of twice the inventory cost ($20,000).

Practical Example: FMV in Action

For instance, if a company donates inventory with a cost of $10,000 and an FMV of $15,000, the deduction would be the cost ($10,000) plus half the FMV excess ($2,500), totaling $12,500. This is within the allowable limit of twice the cost ($20,000).

Happen Ventures’ Approach to FMV and Tax Guidance

While Happen Ventures facilitates the donation process, it is important to note that we provide insights into the rules governing FMV and tax deductions to inform our partners. However, we do not offer tax advice.

Our goal is to ensure that our partners are aware of the potential tax implications of their donations and encourage them to seek professional tax advice to navigate these regulations effectively.

This approach empowers companies to make informed decisions about their inventory donations while ensuring compliance with current tax laws.

Incorporating FMV into the accounting of inventory donations allows companies to navigate the philanthropic landscape with precision, ensuring that their charitable actions are both socially impactful and financially prudent.

As with all tax-related matters, professional advice is recommended to ensure compliance and optimization of benefits.

Where is donation of trading inventory recorded?

The donation of inventory is meticulously recorded as a charitable contribution, reflecting a company’s commitment to social responsibility.

This practice not only showcases a company’s philanthropic efforts but also strategically impacts its financial statements, potentially reducing taxable income within the bounds of IRS regulations.

What is a stock donation? Unpacking Share-Based Generosity

A stock donation is a sophisticated form of corporate giving, where companies donate their own shares to non-profits.

This method can be particularly advantageous, as highlighted by the Harvard Business Review, allowing companies to bypass capital gains taxes on appreciated stock values, while nonprofits benefit from a potentially tax-free asset liquidation.

When it comes to stock donations, the date of contribution is crucial. If a properly endorsed stock certificate is delivered to a qualified organization or an agent of the organization, the date of contribution is the date of delivery. If the certificate is mailed, it’s the date of mailing.

For transfers to a bank or broker acting as an agent, or to the issuing corporation or its agent, the date of contribution is when the stock is transferred on the corporation’s books[2].

What is the purpose of corporate donation?

The purpose of corporate donation is to create a symbiotic relationship between business success and societal progress.

Happen Ventures exemplifies this by aiding companies in navigating the donation process, thereby enhancing their ESG scores, brand reputation, and community impact, all while ensuring a seamless logistical experience.

What is an example of corporate philanthropy? Illuminating Acts

Corporate philanthropy is vividly illustrated by companies that integrate giving into their business ethos.

For example, as reported by UNLEASH, CSR technology is revolutionizing how companies engage in philanthropy, with innovative platforms enabling businesses to donate more effectively and transparently.

Does Nike donate to charity?

Nike’s Community Impact Fund is a testament to corporate philanthropy, donating to grassroots organizations that align with its core values of promoting physical activity and social responsibility, as per their corporate reports.

Does Amazon do donations?

Amazon’s philanthropic arm, AmazonSmile, is a prime example of corporate giving, allowing customers to support their chosen charities through their purchases, at no additional cost, as outlined on Amazon’s community programs page.

Under IRS Code Section 170(e)(3), if a C corporation donates its unwanted inventory to qualified nonprofits, it can receive a federal income tax deduction up to twice the cost of the donated products. The deduction is calculated as the cost of the donated inventory plus half the difference between the cost and fair market-selling price, not exceeding twice the cost[3].

What is the difference between philanthropy and charity? A Discerning Look

Philanthropy and charity, while often used interchangeably, have distinct nuances. Philanthropy is strategic and addresses the root causes of societal issues, while charity provides immediate relief.

This distinction is crucial for companies like Happen Ventures, which aim to create long-term societal value through strategic donations.

What is a corporate charity?

A corporate charity is an entity established by a corporation to streamline its philanthropic efforts.

These charities often focus on areas that align with the company’s business interests, ensuring a coherent and impactful giving strategy.

What is corporate fundraising?

Corporate fundraising involves collective efforts by a company to raise funds for charitable causes.

This can take many forms, from employee-driven initiatives to corporate donation programs, all aimed at amplifying the impact of individual contributions.

What is the meaning of corporate giving? Essence and Impact

Corporate giving is the holistic approach businesses take to contribute to charitable causes. It’s a broad term that encompasses financial donations, volunteerism, and in-kind contributions, all aimed at fostering a positive societal impact.

What is an example of corporate giving?

An example of corporate giving is when a business provides pro bono services to nonprofits, leveraging its expertise to support community initiatives.

This form of giving not only aids the non-profit but also enriches the company’s community engagement.

Best corporate giving platforms: The Top Contenders

Corporate giving platforms are the digital conduits that empower businesses to manage their philanthropic activities efficiently.

These platforms provide the tools for tracking, managing, and reporting on charitable contributions, making corporate giving more accessible and impactful.

In the realm of corporate philanthropy, the platforms facilitating these generous acts are as crucial as the donations themselves. They not only streamline the process but also ensure transparency and impact.

Here are some of the best corporate giving platforms that stand out in 2023:

- isolved

isolved is recognized for its comprehensive employee engagement and corporate giving solutions. It offers a robust platform that simplifies the management of charitable programs, making it easier for companies to launch and track their philanthropic efforts.

- Benevity

Benevity is a leader in the space, known for its user-friendly interface and extensive network of charitable organizations. It provides tools for donation matching, volunteer management, and grants administration, helping companies to maximize their social impact.

- Double the Donation

Double the Donation specializes in matching gift programs, enhancing the power of individual employee contributions. The platform streamlines the matching process, seamlessly enabling employees to double their donations through corporate matching policies.

- America’s Charities

America’s Charities offers a wide range of services including workplace giving campaigns, member engagement, and strategic advisory services. Their platform is tailored to help companies that donate to charities, achieve their CSR goals while engaging employees in meaningful giving.

- Bright Funds

Bright Funds stands out for its focus on giving, volunteerism, grants management, and administration. Companies praise it for its ease of use and the control it offers them over their corporate social responsibility (CSR) initiatives.

- CyberGrants (soon to be Bonterra)

CyberGrants, transitioning to Bonterra, provides a comprehensive suite of tools for grants management and employee engagement. Their platform is known for its flexibility and scalability, catering to the needs of both small businesses and large enterprises.

Happen Ventures: The ultimate solution

Happen Ventures, while not exclusively a corporate giving platform, plays a pivotal role in the ecosystem by partnering with companies to manage the logistics of their donation processes.

These platforms are the engines behind today’s corporate giving, powering a movement towards more strategic and impactful philanthropy. They not only facilitate generosity but also ensure that every dollar donated achieves its intended social impact.

What company donates the most to charity?

Companies like Google, Microsoft, and Walmart consistently receive recognition for their significant charitable contributions in the ever-evolving landscape of corporate giving, as various corporate giving studies report.

Conclusion

In 2023, corporate philanthropy goes beyond just making donations, it’s about the strategic intent and impact of each contribution. Happen Ventures exemplifies this new approach, transforming corporate excess into community progress.