What is ESG compliance? The Blueprint of Responsibility

Imagine a world where businesses are not just about profit margins but about the very air we breathe, the communities we live in, and the ethical standards we uphold. This isn’t a utopian dream but a pressing reality. According to a study by Kroll’s ESG and Global Investor Returns in September 2023, global companies with superior ESG ratings significantly outperformed their counterparts in stock market performance between 2021 and 2023. ESG solutions, once a peripheral concern, have now become central to a company’s reputation and financial health.

But why is this shift happening, and what does it mean for businesses and consumers alike? This article will take you on a journey through the intricacies of ESG compliance, its challenges, and it’s undeniable importance in today’s corporate world.

Table of Contents

Understanding ESG Compliance

At its core, ESG stands for Environmental, Social, and Governance. These three pillars represent a company’s commitment to sustainable practices, social responsibility, and transparent governance.

The emphasis on ESG compliance has grown exponentially due to the heightened awareness and demands of consumers, investors, and stakeholders.

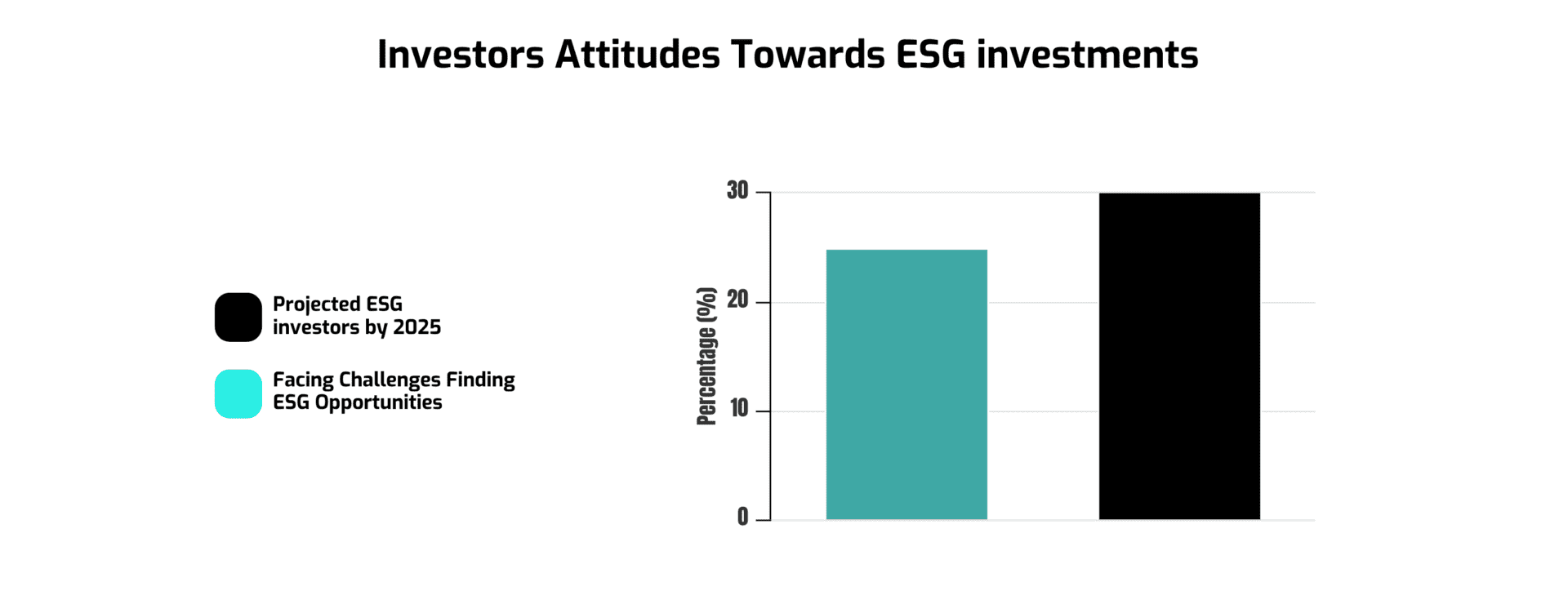

As per iDeals Board, 25% of investors are projected to make ESG investments by 2025, yet 30% admit to facing challenges in finding attractive ESG investment opportunities. This highlights the increasing importance and yet the complexities associated with ESG compliance.

Why Companies Struggle with ESG Compliance

The path to ESG compliance is fraught with challenges:

- Data Collection and Management: As highlighted by iDeals Board, accurate ESG reporting is heavily reliant on dependable data. However, collating and managing this data, especially across global operations, is a monumental task.

- Meeting Investor Expectations: The rise of ESG investors has set the bar high. They are not just looking for financial returns but also a positive global impact.

- Navigating Regulatory Waters: The ever-evolving ESG guidelines make compliance a moving target. With entities like the SEC emphasizing ESG in their 2023 examination priorities, the stakes have never been higher.

The Role of Responsible Stewards and Corporate Citizens

In the face of these challenges, businesses are realizing the importance of evolving from mere profit-driven entities to responsible stewards.

Companies like Microsoft, Unilever, and Salesforce have already set benchmarks by integrating ESG into their core strategies, thereby earning customer loyalty, investor trust, and enhanced brand value.

Beyond Compliance

While compliance is the starting point, ESG excellence is the destination. It’s about going beyond the minimum requirements and truly embedding ESG values into the company’s DNA. This involves continuous learning, adapting, and innovating.

Companies that embark on this journey don’t just mitigate risks, they unlock new opportunities, from tapping into green markets to fostering innovation and driving employee engagement.

Elevate Your ESG Score with Happen Ventures

The traditional waste management methods are becoming obsolete. Happen Ventures’ Beneficial Reuse Service offers a revolutionary approach.

By responsibly managing excess products and supporting local communities, businesses can make a significant positive impact.

The result? A substantial boost in the ESG score and a potential cost-saving of up to 50% on waste management.

Happen Ventures’ Step-by-Step Approach:

- Unwanted Products Collection: The journey begins with the accumulation of unwanted products from various sources.

- Benefit Box or Pallet Placement: These collected items are systematically placed in designated Benefit Boxes or Pallets at specific locations.

- QR Code Scanning for Pickup: With the ease of technology, individuals or organizations can scan a QR code using their mobile devices, signaling Happen Ventures for a pickup request.

- Prompt Pickup and Transportation: Ensuring efficiency, Happen Ventures guarantees the pickup and local transportation of these items within a tight timeframe of 2 to 4 days.

- Distribution to Charities and Non-Profits: The collected items find their way to nearby charitable organizations and Non-profits, ensuring they are put to good use.

- Detailed Impact Report: Transparency is key. Happen Ventures provides its clients with a comprehensive impact report, detailing the positive effects and outreach of the service.

ESG Trends to Watch in 2023 and Beyond

The ESG wave is here to stay. Here are some trends shaping 2023:

- Dealing with the Climate Crisis: Major brands like Shell and Microsoft are committing to net-zero emissions, with goals set for 2050 and 2030, respectively.

- Sustainable Food and Farming: The European Green Deal’s “From Farm to Fork” initiative aims to make food sustainable, promoting organic farming and reducing food waste.

- Transparent Supply Chains: The demand for clarity in product origins is rising. Companies are expected to ensure their supply chains are free from sanctioned entities and illegal labor practices.

- Sustainable Finance: The European Green Deal is also channeling more investments into green companies. Green bonds are being issued to support eco-friendly practices.

- Labour Practices and Human Capital: The pandemic has shifted perspectives on work. Companies are now focusing more on employee well-being, mental health, and job satisfaction.

Final Thoughts

The intertwining of business success with ESG compliance is evident. It’s not about mere compliance but about making a genuine, measurable difference. As we navigate this transformative phase, businesses face a clear choice: either be a passive observer or a proactive pioneer in this revolution. The decision will shape their future.