Today’s economy, where every tick is a transaction, the pulse of corporate donation is being redefined. No longer confined to the realm of cash transactions, the art of giving within the corporate world is witnessing a transformative shift towards stock donations, a move that’s reshaping the landscape of corporate philanthropy.

In this intricate dance of assets and altruism, companies are discovering the power of leveraging their stock portfolios for social good, a strategy that’s as impactful as it is insightful.

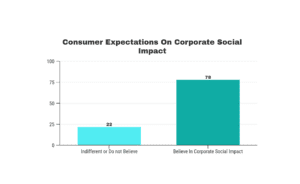

Among a backdrop where 78% of consumers believe companies must positively impact society, the concept of corporate donation is evolving.

It’s no longer just about writing checks, it’s about making strategic contributions that carry the potential for growth, both for the beneficiaries and the donors’ long-term corporate reputation.

This article peels back the layers of this emerging trend, offering a deep dive into the world of stock donations.

We’ll explore the mechanics, the benefits, and the profound impact these contributions can have on both the corporate sphere and the wider community.

Table of Contents

The Essence of Stock Donations

At its core, a stock donation is the transfer of ownership of securities from a corporation to a non-profit.

Unlike cash donations, this form of giving leverages the growth of the market to benefit charitable causes. It’s a lesser-known path to philanthropy that can amplify the impact of a company’s giving strategy.

For the recipient, these donations can mean a steady flow of resources that are not subject to the volatility of cash donations, which can fluctuate with a company’s fiscal health.

For the donor, it’s an opportunity to make a significant impact while also reaping potential tax benefits—a dual advantage that’s as financially savvy as it is socially conscious.

Strategic Philanthropy: Beyond Cash Donations

Strategic philanthropy is about aligning a company’s charitable efforts with its core values and objectives. Stock donations represent a sophisticated arm of this strategy, one that requires a nuanced understanding of both market trends and social needs. They allow companies to support causes they care about in a way that also considers their long-term financial health.

This approach transcends the traditional view of corporate giving as a one-off charitable expense, positioning it instead as an integral part of a company’s identity and legacy.

The Tax-Smart Approach to Giving

Navigating the tax implications of stock donations can be complex, but understanding the basics is crucial for corporations looking to optimize their philanthropic impact.

When a company donates stock, it can often claim a tax deduction for the full fair market value (FMV) of the stock at the time of the donation, not just the original purchase cost.

This means that if the stock has appreciated in value, the company can donate the stock and potentially eliminate the capital gains tax they would have incurred if they had sold the stock instead.

According to a guide by Convoy of Hope, when you donate stock directly to a charity, you are eligible for a charitable deduction equal to the FMV of the donated stock.

This aligns with the information provided by Silver Cross Hospital, which suggests that donating stock can offer more significant tax savings than cash donations, especially if your investment portfolio has seen substantial gains.

It’s important to note that while this section provides a general overview, companies should consult with a tax professional to understand the specific benefits and requirements applicable to their situation.

Happen Ventures: Pioneering the Corporate Donation Logistics

Happen Ventures emerges as a beacon in the corporate donation landscape, offering a bridge between the corporate world and charitable organizations. By managing the intricate logistics of stock donations, Happen Ventures ensures that the process is not only efficient but also impactful.

They partner with a variety of charities, focusing on those that can make the most of these non-traditional donations, thereby maximizing the community benefit.

The approach of Happen Ventures is particularly relevant in today’s corporate giving climate. Forbes highlights that even during economic downturns, some companies maintain or even increase their philanthropic budgets.

Happen Ventures’ model fits well within this trend, offering companies a way to continue their charitable efforts in a financially sensible manner.

Measuring Impact: The Ripple Effect of Stock Donations

Understanding the impact of stock donations goes beyond the immediate financial benefit. It’s about tracing the ripple effect these contributions have on communities and causes.

Companies are increasingly seeking to quantify this impact, not just for the sake of corporate reports, but to genuinely understand the change they’re catalyzing.

Measuring impact can involve tracking the progress of the projects funded by the donations, assessing the long-term benefits to the recipients, and evaluating the social return on investment (SROI).

This data not only informs future giving strategies but also serves to communicate the company’s commitment to social responsibility to stakeholders and the public.

A report by Giving USA, as highlighted by Ruffalo Noel Levitz, notes a decline in giving after record years, suggesting a more competitive philanthropic landscape where the impact of each dollar (or stock share) counts more than ever. In this context, companies are not just asking if they should give, but how they can give smarter.

Partnering for a Purpose: Selecting the Right Non-Profits

The choice of a non-profit partner is a critical decision in the stock donation process. It’s not just about finding a charity that aligns with a company’s values, but also one that can effectively utilize stock donations to further their mission.

Companies must conduct thorough due diligence, assessing the non-profit’s track record, governance, and financial health. Happen Ventures takes this a step further by vetting smaller charities that often lack visibility but have the potential to make a significant impact.

This approach ensures that stock donations reach the places where they can do the most good, supporting causes that might otherwise be overlooked.

The Winkler Group points out that understanding philanthropy trends is crucial, and Happen Ventures’ focus on beneficial reuse and sustainability is a direct response to these evolving dynamics.

By selecting non-profits that can leverage stock donations for maximum community benefit, companies can ensure their contributions are both meaningful and measurable.

Conclusion

Stock donations represent a sophisticated and strategic avenue for corporate giving, one that aligns financial acumen with social conscience. As we’ve explored, the benefits of such Corporate donation extend beyond the immediate tax advantages, fostering a culture of generosity that resonates with stakeholders and communities alike.

Happen Ventures stands at the forefront of this movement, facilitating a seamless bridge between corporations and non-profits. By managing the logistics of stock donations, they ensure that every share contributes to a larger narrative of sustainable and impactful giving.