What does ESG stand for? A Glimpse into Its Core

Have you ever paused to consider the driving force behind today’s most successful and ethical businesses? Enter ESG solutions – a term that’s more than just a buzzword in the corporate realm. In the ever-evolving landscape of business and investment, ESG solutions have emerged as a pivotal compass, guiding entities towards sustainable, ethical, and profitable futures.

In 2023, understanding the Environmental, Social and Governance is more than a trend, it’s a pivotal shift reshaping corporate strategies and investment paradigms. Join us as we delve deeper into the heart of ESG and its undeniable influence on the future of business.

Table of Contents

The Evolution of ESG: From “Nice-to-Haves” to Imperatives

ESG, once perceived as mere “nice-to-haves,” has now become an integral part of business and investment decisions. As the world grapples with challenges like climate change, social injustices, and global health crises, the significance of Environmental, Social and Governance has skyrocketed. Companies and investors are now adopting a holistic approach, integrating ESG factors into their strategic blueprints.

The Power of Data in Environmental, Social and Governance

In 2023, a data-driven approach to ESG took center stage. With advancements in technology and data analytics, companies are harnessing the power of data to assess, manage, and enhance their performance. This shift is fueled by:

- Reliable ESG Data: With ESG metrics influencing decisions, there’s a growing demand for accurate data.

- Stakeholder and Regulation: Companies are adopting data-driven strategies for increased transparency and to meet stakeholder and regulatory demands.

The Rise of ESG Reporting Platforms

In recent years, there’s been a surge in the development and adoption of ESG reporting platforms. These platforms allow businesses to seamlessly integrate data into their operations, offering real-time insights and analytics. Using these platforms, companies can track their performance and compare it to industry standards, ensuring competitiveness and adherence to global best practices.

Global Frameworks Championing Transparency

The call for robust global frameworks addressing environmental and social challenges has grown louder. From climate change to human rights, there’s a pressing need for accountability and transparency. Industries worldwide are responding by adopting frameworks that promote transparency and hold entities accountable for their Environmental, Social and Governance performance.

The Role of Third-Party ESG Auditors

With the increasing emphasis on ESG transparency, third-party auditors have become indispensable. These auditors play a crucial role in verifying the authenticity of a company’s ESG claims, ensuring that they adhere to global standards. Their unbiased evaluations provide investors and stakeholders with the confidence that a company’s ESG reporting is both accurate and reliable.

Impact Investing: Aligning Beliefs with Investments

Impact investing, a movement where investments align with social or environmental objectives, has seen a meteoric rise. As investors become more conscious of global challenges, they’re channeling their capital towards creating positive change, ensuring their investments resonate with their beliefs.

The Interplay Between ESG and Circular Economy

The circular economy, a model that emphasizes the reuse and recycling of resources, aligns perfectly with goals, particularly in the environmental domain. Companies embracing this model not only reduce waste but also ensure the sustainable use of resources. By integrating the principles of the circular economy, businesses can further enhance their ESG scores, showcasing their commitment to environmental stewardship.

Elevating ESG Scores with Happen Ventures’ Beneficial Reuse Approach

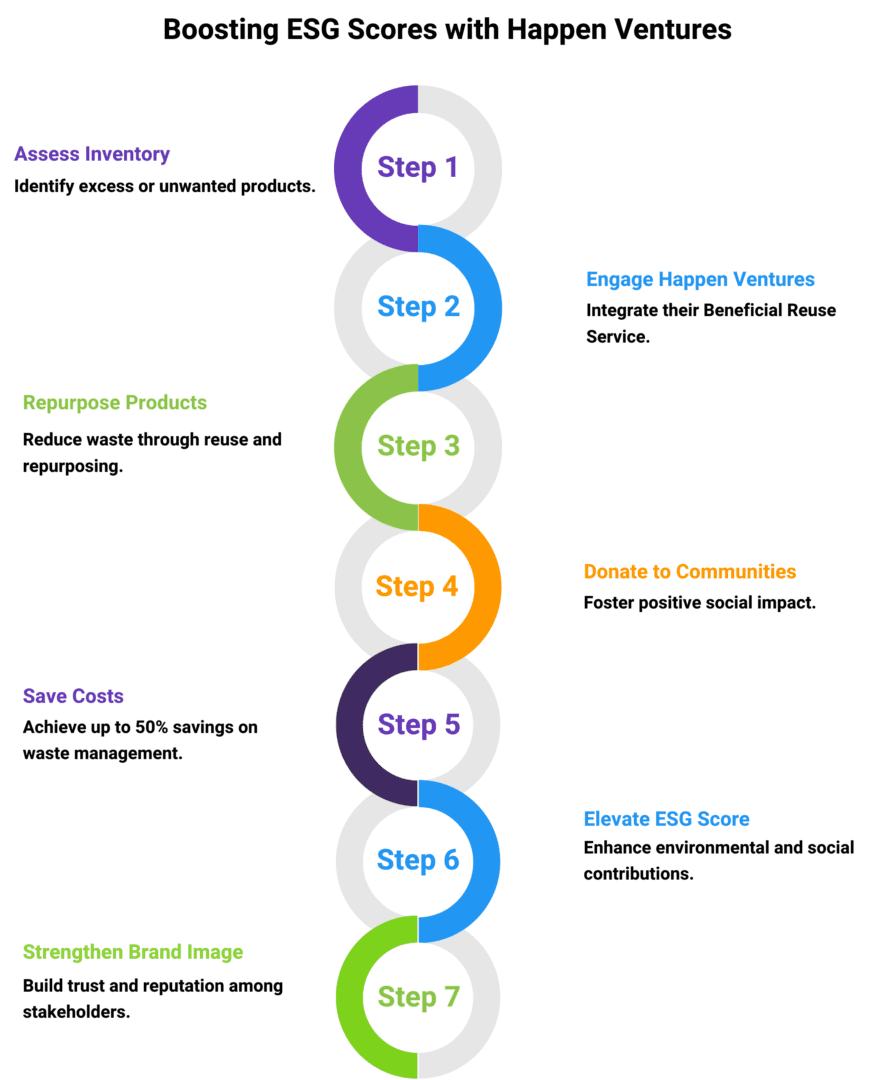

In the quest for businesses to elevate their Environmental, Social and Governance scores, innovative solutions are paramount. Enter Happen Ventures and their Beneficial Reuse Service. This unique approach presents an eco-friendly option for businesses managing excess or unwanted products. Instead of contributing to waste, these products are repurposed, offering substantial cost savings of up to 50% on waste management expenditures.

But the benefits don’t stop at cost savings. Happen Ventures’ approach is a testament to the power of circular economy principles in action. By donating items to local communities, businesses not only reduce waste but also generate a positive social impact. This dual benefit of environmental and social upliftment significantly boosts a company’s Environmental, Social and Governance score.

By partnering with Happen Ventures, companies not only adopt sustainable practices but also make a clear commitment to a greener and fairer world, bolstering their brand reputation in an environmentally-conscious era.

The Holistic Approach to Net-Zero

Achieving net-zero emissions requires a comprehensive strategy, considering the complete lifecycle of emissions. From transitioning to renewable energy to decarbonizing supply chains, businesses are adopting multifaceted approaches to combat climate change and inch closer to their net-zero goals.

5G: The Unsung Hero of ESG

The advent of 5G technology promises to revolutionize the Environmental, Social and Governance initiatives. With faster communication, reduced latency, and enhanced capacity, 5G is set to empower smart cities, promote renewable energy, and facilitate precision farming, all of which are pivotal for advancing sustainability goals.

ESG in Emerging Markets: Challenges and Opportunities

Emerging markets, with their rapid growth and development, present both challenges and opportunities in the ESG realm. While these markets often grapple with issues like inadequate regulations and infrastructure, they also offer immense potential for ESG-driven innovations. In 2022, India saw a 15% rise in ESG investments, underscoring its growing sustainability commitment.

Environmental, Social and Governance in 2023: A Closer Look

Large-scale ESG investing trends include addressing climate change, biodiversity loss, social inequalities, and regulatory challenges, along with recent debates on greenwashing and defining ESG’s role.

Amidst European war, inflation, unstable energy markets, political unrest, and recurring climate disasters, the 2023 ESG landscape is reevaluating major developments to discern their influence on investment trends and corporate challenges and opportunities.

Conclusion

As we navigate through 2023, ESG stands at the forefront of business and investment strategies. With emerging trends like data-driven ESG approaches, impact investing, and the role of 5G in sustainability, the Environmental, Social and Governance landscape is evolving at an unprecedented pace. For businesses aiming to boost their ESG scores, solutions like Happen Ventures’ Beneficial Reuse Service offer a promising avenue. By aligning with these trends and seeking expert guidance, businesses can not only thrive but also contribute to a more sustainable and equitable world.