As we stand in 2023, the concept of corporate donation has evolved from a mere act of goodwill to a sophisticated element of business acumen.

Companies are no longer content with simply writing checks, they seek to make each contribution resonate with purpose and precision.

This article isn’t just another discussion on corporate giving, it’s a navigation chart for the uncharted waters of inventory donations, guiding businesses through the intricacies of fair market value, tax benefits, and the transformative approach of Happen Ventures.

Table of Contents

The Strategic Shift in Corporate Giving

Gone are the days when corporate philanthropy was a secondary concern, a line item on a balance sheet that could be adjusted at the end of the financial year.

Today, it’s a strategic pillar that upholds the edifice of a brand’s reputation and its relationship with society.

Inventory donations, a concept that marries the surplus of corporate warehouses with the deficit in community resources, are gaining traction. But why this shift?

Inventory donations offer a dual advantage: they clear excess stock while supporting community initiatives. However, the process isn’t without its challenges.

Companies often grapple with logistical hurdles, from identifying the right non-profit partners to managing the distribution of goods.

Moreover, the valuation of donated items for tax purposes can be a complex affair, with the fair market value (FMV) often standing as a question mark.

Understanding Fair Market Value (FMV) in Donations

Fair Market Value (FMV) is the estimated price of an item if it were sold on the open market. Determining this value is crucial for inventory donations, as it directly impacts the tax benefits a company can claim.

However, FMV is not a fixed number, it’s influenced by market conditions, the item’s condition, and its utility.

For instance, how do you determine the FMV of last season’s clothing line or technology that’s been superseded by newer models?

The answer lies in a thorough assessment that considers the item’s desirability, use, and the prices of comparable items. It’s a meticulous process that demands diligence and can significantly affect the company’s financials and philanthropic impact.

Tax Considerations for Inventory Donations

When it comes to tax deductions, the Internal Revenue Service (IRS) has clear guidelines for inventory donations.

However, navigating these rules can be akin to walking through a regulatory maze. It’s essential for companies to understand the basics: not all donations are equal in the eyes of the taxman, and the deductible amount can vary based on the type of inventory and the recipient organization.

For example, a donation to a public charity can yield a different deduction than a contribution to a private foundation.

And while we won’t delve into tax advice, we’ll illuminate the path with the IRS’s general rules, helping businesses to avoid common missteps and capitalize on the potential tax benefits of their good deeds.

The Happen Ventures Approach to Philanthropy

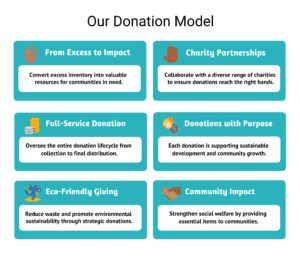

Happen Ventures, a beacon for companies navigating the complexities of inventory donations. Their model is simple yet revolutionary: transform potential waste into community wealth.

By partnering with a myriad of charities, Happen Ventures streamlines the donation process, handling everything from pickup to distribution.

But what sets them apart is their focus on the ‘how’ rather than just the ‘what’. They don’t just facilitate Corporate donation, they craft a narrative of change, ensuring that each item donated serves a purpose and supports sustainable development.

It’s a model that not only benefits the environment but also fortifies the social fabric of communities.

Calculating the Impact: Beyond the Bottom Line

The true measure of a donation’s worth extends far beyond its impact on a company’s tax filings. It’s about the stories that unfold as a result of that contribution, the child who receives new school supplies, the family that is clothed, the community that is uplifted.

But how does a corporation measure these intangible benefits?

The answer lies in a concept we might call ‘holistic accounting’. This involves tracking the journey of donated items and the ripple effect they have.

It’s about qualitative data, testimonials from non-profit partners, stories from the community, and feedback from employees involved in the donation process.

These narratives, when shared, can amplify a company’s social impact and foster a deeper connection with consumers who increasingly value socially responsible brands.

Inventory Donations Done Right

Consider the case of a well-known tech company that donated unsold products to educational non-profits, providing technology to underfunded schools.

Not only did this initiative offer a substantial tax deduction, but it also enhanced the company’s brand image and employee satisfaction.

The key to their success?

A strategic approach that matched surplus inventory with specific community needs, ensuring that their donations made a tangible difference.

Another example is a fashion retailer that turned overstocked clothing into a community empowerment tool.

By partnering with local non-profits, they provided attire for job interviews to those in need, directly contributing to economic development in the communities they served. These cases exemplify the potential of Corporate donation when executed with intention and strategy.

Best Practices for Corporate Donors

For companies inspired by these stories, the path forward involves adopting best practices that ensure their donations are both impactful and compliant with tax regulations. Here are some guiding principles:

- Documentation is Key: Maintain thorough records of all donated items, including descriptions, condition, and the method used to determine FMV.

- Vet Your Partners: Collaborate with non-profits that align with your company’s values and have the infrastructure to effectively distribute donations.

- Engage Your Team: Involve employees in the donation process to foster a culture of giving and ensure a transparent and heartfelt contribution strategy.

- Communicate Your Impact: Share the outcomes of your donations with stakeholders through reports, social media, and press releases.

Conclusion

As we wrap up our exploration into the world of corporate donation, it’s clear that this form of giving is not just a line item, it’s a narrative of change, a strategic decision that can enhance a company’s social and environmental footprint.

By embracing the principles of fair market value, understanding tax considerations, and adopting the Happen Ventures approach, businesses can ensure that every contribution truly counts.