What Is ESG Solution in Business? Meaning, Examples, and Practices

Jessica Gonzalez

Global Chief Executive | Founder Happen Ventures

It’s 2026. The business world has changed. Remember when the most admired leaders were the ones who made the most money, no matter what the cost? Those days are over. Today, if you want your company to live long and sustainably, you need something more. You need a reputation.

This is where ESG solutions come into play. You may have heard this set of letters and thought, “Oh, this is something complicated for large corporations.” In fact, everything is much simpler. Let’s break it down in plain English: what it is, why you need it, and how it works in real life.

Table of Contents

What Does ESG Mean in Business?

Let’s start with the basics. When someone asks what ESG is, they simply want to know: Is your company responsible? Is it safe to do business with you?

The abbreviation ESG stands for three simple things:

- Environmental – Do you reduce pollution and waste in your operations?

- Social – Do you treat your employees and customers humanely?

- Governance – Do you run the company ethically, pay taxes properly, and communicate honestly with partners?

That’s the ESG definition in a nutshell. Think of ESG as a documented code of responsibility for your business. In 2026, these are no longer just beautiful words for an advertising brochure. These are becoming baseline expectations. If you ignore these expectations, many large clients and lenders may refuse to work with you.

So, what is ESG in business? This is your entry ticket to working with large, trust-focused partners. This is proof that you are a reliable partner, not a short-term player looking for a quick win.

What are ESG Solutions?

The idea is good, but how to implement it? People often confuse the philosophy itself with the tools. When we talk about ESG solutions meaning, we mean specific actions. This answers a practical question: what specific steps should we take first?

A real ESG solution is a tool that solves a problem. For example:

- Problem: You spend a lot of money on electricity.

Solution: Put smart meters or solar panels on the roof of a warehouse. - Problem: Employee turnover is high.

Solution: Provide solid benefits and health insurance, safe working conditions, and clear safety procedures, and run compliant payroll, pay all required taxes and official contracts.

Today there are strict ESG requirements. If you want to take out a favorable loan or find an investor, you will be asked about these things. Your ESG initiatives are a form of risk protection. They show that your business has a future and will not close due to fines or scandals.

What is an ESG Service?

Imagine that you decided to put your company in order. Where to start? You won’t be running around with a notebook and counting every discarded box or interviewing every employee manually. You need help.

This is where the concept of service comes in. This is when you hire a professional or buy a program that does routine work for you. By 2026, many companies have moved beyond spreadsheets to ESG platforms. There is special ESG software for this. It collects all the data in one place and shows it on the screen: “Here we are doing well, and here we are losing money.”

But there are a lot of programs now. How not to make a mistake and not buy something unnecessary? If you are currently looking for reliable ESG software solutions, we highly recommend that you check out our separate analysis. There we explain how to choose the tool that is right for you.

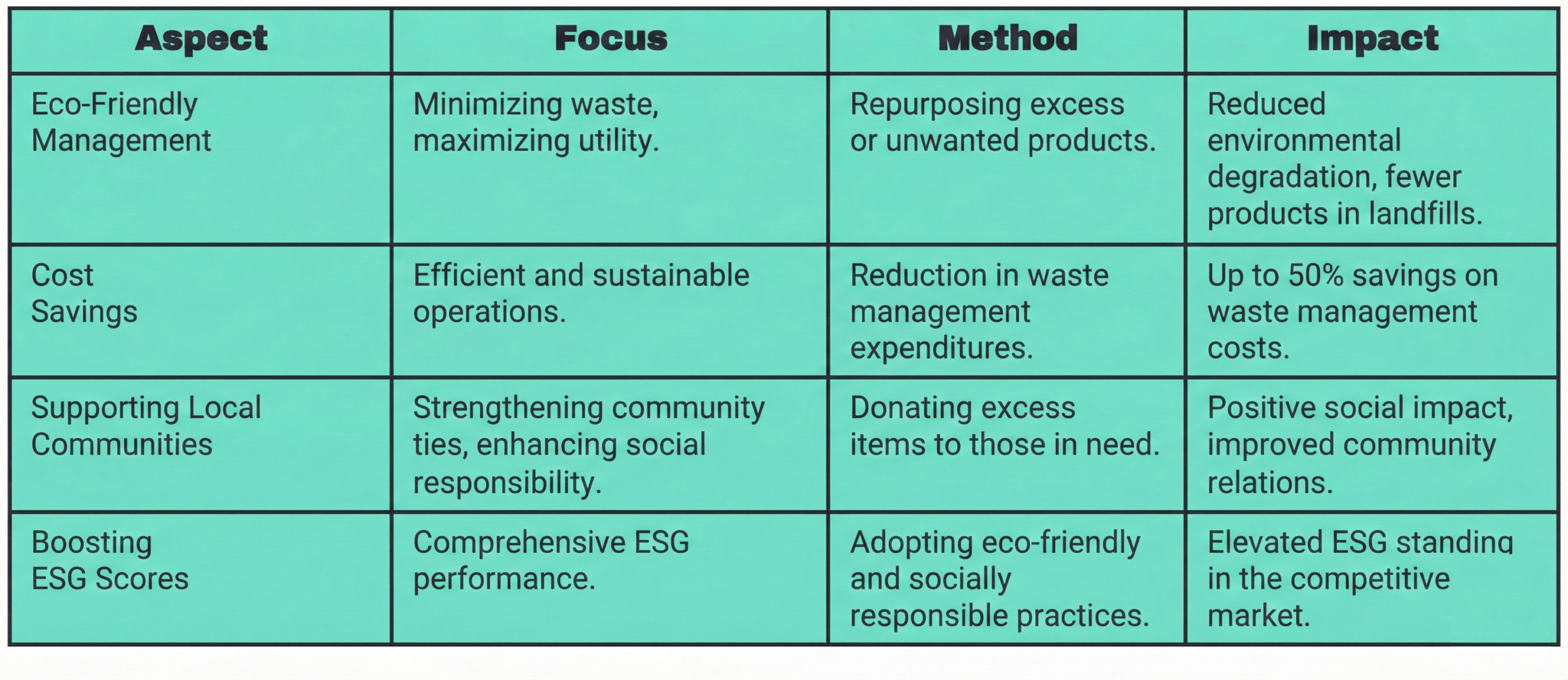

The right environmental, social and governance solutions help not only to write beautiful reports, but also to really save money. For example, if you set up a well-designed recycling and waste-management program (waste collection and processing), you can reduce disposal costs and recover value from recyclables, instead of paying for it to be taken to a landfill.

What are Some Examples of ESG?

Enough theory. Let’s look at real ESG practices that work in real life. What do responsible companies do to be respected?

Here are simple examples that explain what is ESG and examples:

- Ecology

It’s not just about saving the Amazon rainforest. It’s about your savings.

Waste as a resource: Smart companies are changing their understanding of what recycling meaning. It’s not just throwing cardboard in the blue bin. It’s making sure that this cardboard comes back to you in a new box.

Energy: Many businesses know that recycling conserves energy. It’s cheaper to recycle an aluminum can than to make a new one. This is real savings on your electricity bills. You pay less – you earn more. - Society

This is about ordinary human attitudes.

Fairness: Paying women and men the same for the same work.

Safety: to prevent injuries on the job for the warehouse worker.

Care: Give people the opportunity to learn so that they grow with the company. - Management

This is about trust and honesty.

Transparency: Do not hide profits offshore and pay taxes honestly.

Integrity: No bribes and “nepotism” when hiring not a professional, but a relative of the director.

Openness: Honestly talk about your successes and even failures (because everyone makes mistakes).

When you do these simple things, you answer the question: What does ESG mean? It’s simply being a responsible, modern business that is pleasant and safe to work with.

Why is it Profitable?

Some will say that ESG meaning is just unnecessary expenses. But this is a myth. In 2026, customers will vote with their wallets. They will rather buy goods from someone who cares about nature and people than from someone who thinks only about quick profit. We checked the history of this issue and relied on data from Wikipedia.

In short, ESG solutions are not magic or charity. It is just common sense. It is a way of doing business so you can build a business you’re proud of, and the profit grows steadily and without risks. Source: en.wikipedia.org

FAQ

What are The 4 Pillars (standards) of ESG?

Although the name has three letters (Ecology, Society, Governance), some frameworks also discuss a fourth dimension, such as long-term value creation or prosperity. The logic is simple: to help the world, a business must be profitable. That is: Planet, People, Principles, and Prosperity (or Profit). This is the complete picture of success.

What is ESG in Simple Words?

In simple words, what is ESG in business is a test of a company’s integrity.

- E – Do you not pollute the air?

- S – Do you respect your employees?

- G – Do you not lie in your reports?

If the answer to all questions is “yes” – congratulations, your business is ready for the future.