What is Sustainable Supply Chain Financing? Unpacking the Term

In 2023, sustainable supply chain financing isn’t just a trend, it’s a necessity. It’s about making smart, eco-friendly choices that resonate with today’s market demands. But what does this really mean for businesses?

Let’s dive deeper into this concept, exploring its significance and how it’s reshaping the business landscape.

Table of Contents

The Evolution of Sustainable Supply Chain Financing

Gone are the days when supply chain financing was solely about reducing expenses. Now, it’s about integrating environmental and social governance (ESG) into the core business strategy. This evolution reflects a broader societal shift towards sustainability.

Companies are now looking at the long-term impacts of their operations on the environment and society. It’s about creating a supply chain that not only saves money but also conserves resources, reduces carbon footprint, and promotes fair labor practices.

Catalysts for Change:

This shift is propelled by increased consumer awareness and stricter environmental regulations. Businesses are recognizing that sustainable practices can lead to long-term financial gains and risk mitigation.

Consumers are more informed and concerned about how products are sourced, manufactured, and delivered. This consumer consciousness, coupled with regulatory pressures like carbon taxes and sustainability reporting standards, is pushing companies to rethink their supply chain strategies.

Sustainable Supply Chain Financing Inspirational Examples:

Look at Unilever’s sustainable living plan or Apple’s commitment to carbon neutrality. These aren’t just ethical choices, they’re strategic business moves that have set these companies apart in their respective industries.

Unilever’s plan focuses on reducing environmental impact and increasing social impact across its supply chain, while Apple has invested heavily in renewable energy and green materials to reduce its carbon footprint. These examples show how sustainability can be a core part of a company’s value proposition.

Decoding Sustainable Supply Chain Financing

At its heart, sustainable supply chain financing is about creating a balance between profitability and environmental responsibility. It involves scrutinizing every link in the supply chain for sustainability.

This means evaluating suppliers on their environmental practices, optimizing logistics to reduce emissions, and ensuring that products are made and disposed of in an environmentally friendly way.

Business Benefits:

This approach can lead to reduced operational costs through energy savings and waste reduction. It also opens up new markets and customer segments that prioritize eco-friendly products.

Sustainable practices can also lead to improved brand reputation and customer loyalty, as well as reduced regulatory risks.

Navigating Challenges:

The main hurdle for many businesses is the initial investment and the complexity of overhauling existing supply chains.

However, with strategic planning and leveraging green financing options, these challenges can be effectively managed. Businesses need to conduct a thorough cost-benefit analysis to understand the long-term benefits of sustainable supply chain practices.

The Tech Revolution in Supply Chains

Technologies like AI and blockchain are playing a pivotal role in making supply chains more transparent and efficient.

For instance, blockchain can be used to trace the sustainability footprint of products from origin to end-user. AI can optimize logistics and inventory management, reducing waste and improving efficiency.

The Power of Data:

Big data analytics is enabling companies to make informed decisions about their supply chain operations, identifying areas where sustainable practices can be implemented for maximum impact.

Data can reveal insights into energy consumption, waste generation, and supplier practices, helping companies to make targeted improvements.

Looking Ahead:

We’re likely to see more integration of AI and IoT in supply chain management, further enhancing efficiency and sustainability. These technologies will enable real-time monitoring and decision-making, leading to more agile and responsive supply chains.

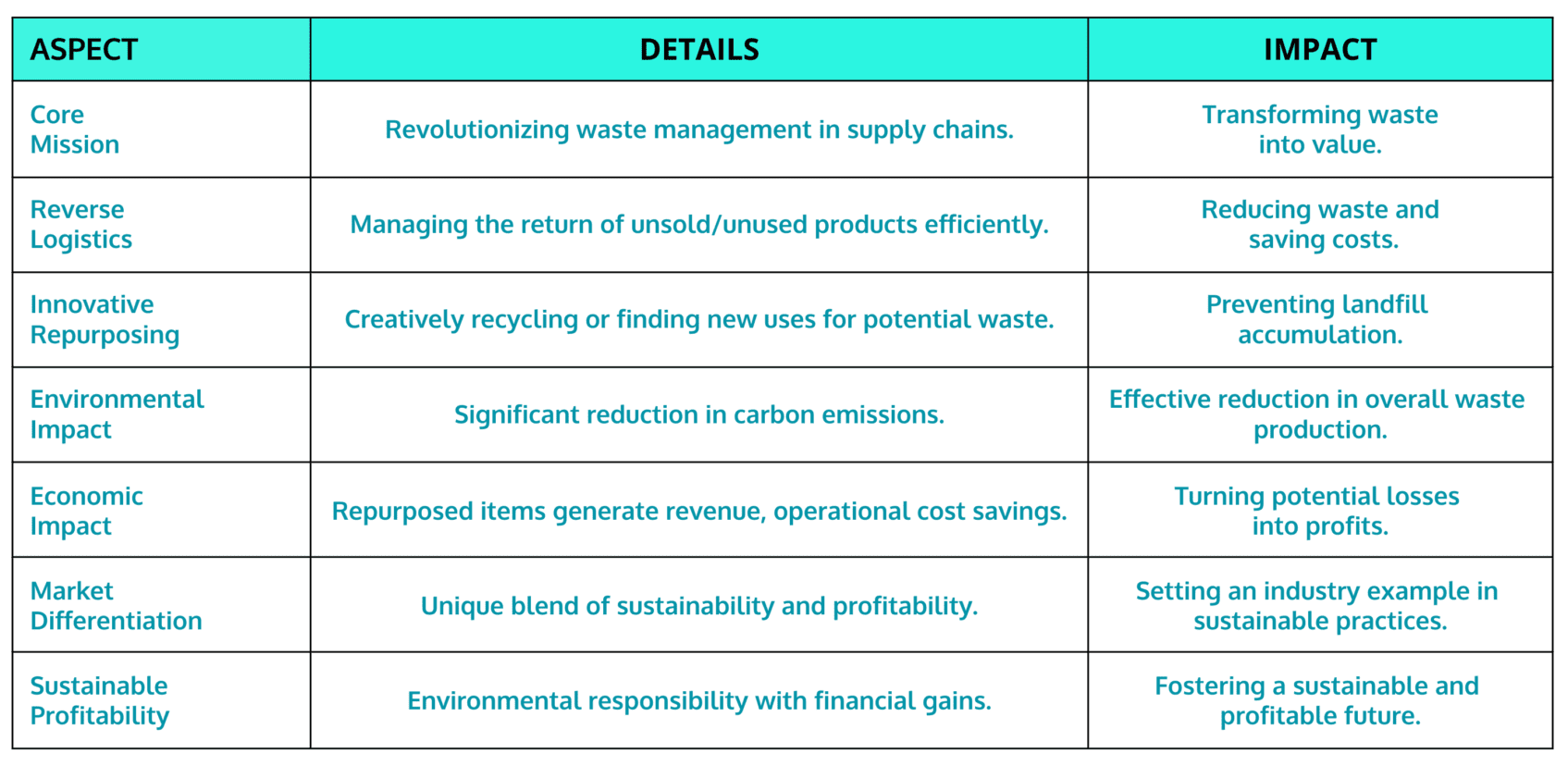

Happen Ventures – Leading by Example

Happen Ventures is redefining waste management in supply chains. Their focus on reverse logistics is not just reducing waste but also creating value from returned or unsold inventory. They have developed innovative processes to repurpose or recycle products that would otherwise end up in landfills.

Strategic Impact:

Their methods have shown significant reductions in carbon emissions and waste, while also turning potential losses into profits for their clients. By finding new markets or uses for unsold products, they are helping companies to improve their bottom line and reduce environmental impact.

A Differentiator in the Market:

Happen Ventures’ model is a standout in the industry, showcasing how specialized focus on sustainability can lead to both environmental and economic benefits. Their approach is a prime example of how businesses can be both profitable and sustainable.

The Global and Regulatory Landscape Of Sustainable Supply Chain

Sustainable supply chain financing is gaining momentum globally, with businesses in Europe, Asia, and the Americas adopting greener practices. This global shift is partly driven by international agreements like the Paris Accord. Companies are realizing that sustainable practices are essential for global competitiveness.

The Role of Regulations:

Governments are increasingly incentivizing sustainable practices through subsidies and tax breaks, while also setting stricter environmental standards for businesses. These regulations are pushing companies to adopt more sustainable practices to comply with legal requirements and avoid penalties.

Contributing to Global Goals:

These efforts are crucial in meeting international objectives like the UN’s Sustainable Development Goals, particularly those related to responsible consumption and climate action. By adopting sustainable supply chain practices, businesses are contributing to global efforts to combat climate change and promote sustainable development.

Practical Steps for Implementation

Businesses can begin by assessing their current supply chain for sustainability gaps. This involves looking at suppliers, materials used, energy consumption, and waste management practices. Identifying these areas is the first step towards developing a more sustainable supply chain.

Collaboration is Key:

Forming partnerships with sustainability experts and leveraging networks like the Sustainable Supply Chain Foundation can provide valuable insights and resources for this transition. Collaboration with NGOs, government agencies, and industry groups can also provide support and guidance.

Tracking Progress:

Implementing sustainability metrics and regularly reviewing progress is essential for continuous improvement and for communicating these efforts to stakeholders and customers. This can involve setting specific targets for carbon emissions, waste reduction, and sustainable sourcing, and regularly reporting on progress towards these goals.

Conclusion

Sustainable supply chain financing is more than a compliance requirement, it’s a strategic business approach that aligns with the growing global consciousness around environmental sustainability. By adopting these practices, businesses are not just contributing to a greener planet but are also positioning themselves for sustainable growth and success in a rapidly changing world. The journey towards a sustainable supply chain is challenging but rewarding, offering a path to resilience, innovation, and long-term profitability.